Key Accomplishment

Restructured the Organization to Reduce Insurance ExpenseSituation:

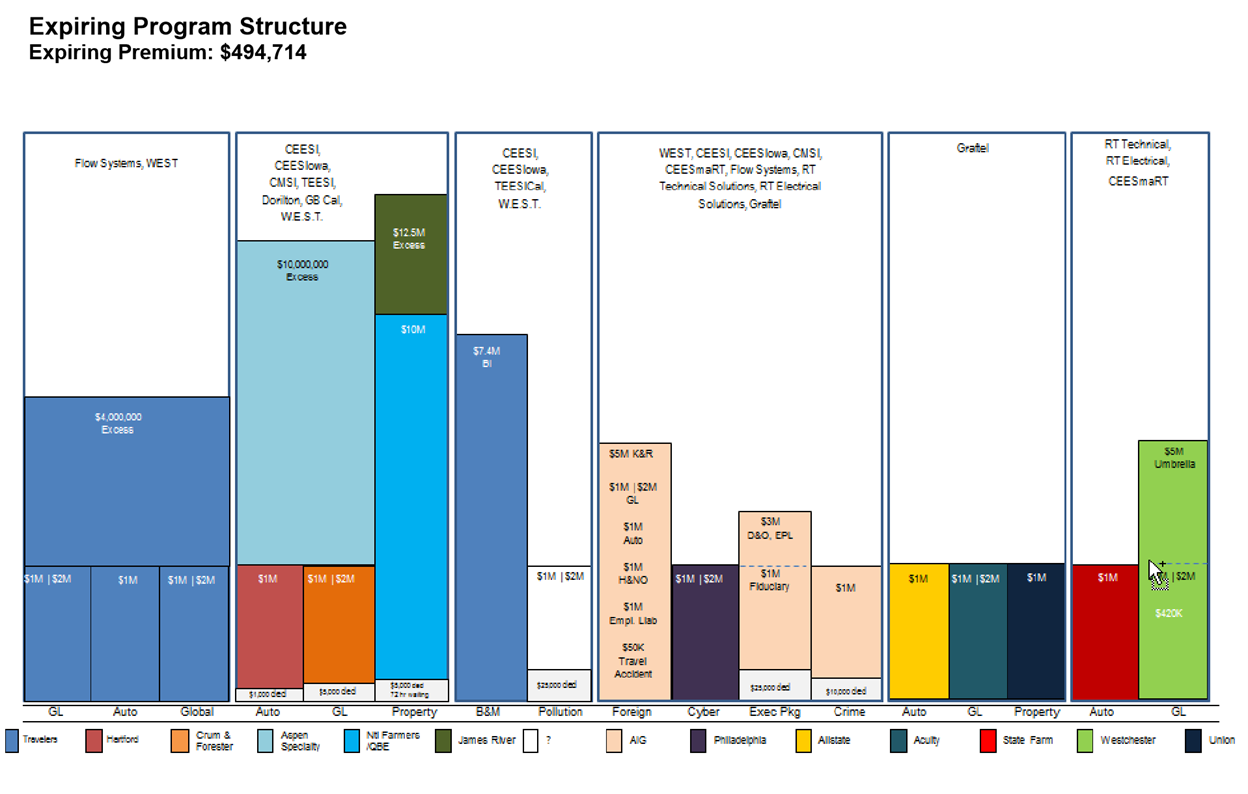

As Western Energy Support and Technology (WEST) grew by acquiring and starting new companies, each individual entity was operated independently under the direction of WEST. After careful analysis of each companies’ insurance program it was determined that not only were some entities under insured but there were also overlapping on some areas. Additionally, the company was not taking advantage of potential discounts for bundling insurance coverage packages.

Action Plan:

- Each SBUs insurance program was collected and analyzed, a total of 14 different insurance providers with six different programs.

- Multiple insurance brokers were researched and interviewed across the United States. Selection was made based on the following guidelines:

- Accessibility to build strong relationships with multiple insurance providers in-order-to leverage quotes to obtain best pricing schemes.

- Ability to understand complexities of multiple operating SBU’s in varying industries.

- Ability to leverage knowledge of business risks and verify proper coverage based on comparable businesses.

-

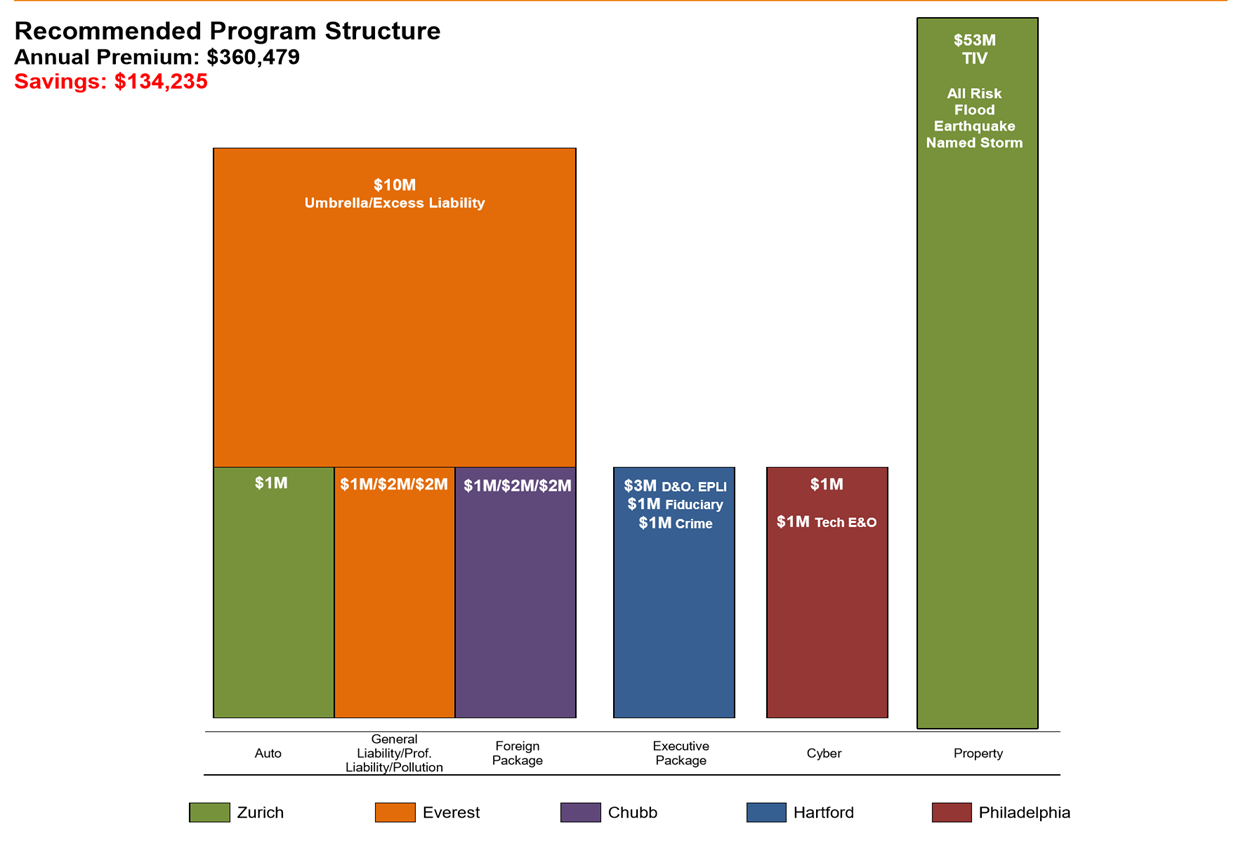

After carefully selecting the best fit for our organizations, the program consolidated auto, general liability, foreign, direction & officers, cyber, property, and umbrella.

-

New consolidated program was selected and rolled out to each individual entity.

Results:

Insurance for seven individual SBUs were consolidated and restructured to insure maximum coverage. One contact was established on the broker side to enable ease of information and certificate issuance. A savings of over $134,000 was realized by the organization.